Last Week's Big Happenings: Fed Mischief, This Gripping Chart, and One More Thing

Last week we discussed recent Fed mischief: the "big four" televised gathering along with the "secret" meetings, along with Yellen "filling in" President Obama about what's going on with the U.S. economy - all within the space of a few days. Our assessment that this spelled "trouble" stands, but first let's clarify something.

If trouble's brewing, and the Fed's now swinging into crisis mode, you have to seriously consider the possibility of the Fed taking some dramatic action. Like what? Well, we've seen the Japanese central bank buying ETFs in their stock market. Maybe that's on tap here. After all, no matter what you hear from the Fed or certain Wall Street economists about the economy being in good shape and getting better,you have to wonder what they're talking about as earnings continue to disappoint. Yes, disappoint, despite all the talk of "beating estimates." Earnings, measured correctly, that is, compared to the previous year's quarter, have been down four quarters in a row. What you hear about earnings "beating estimates" amounts to this: Wall Street sets the bar low, low enough to assure results will exceed estimates. There's nothing positive about that. It's just gaming the system.

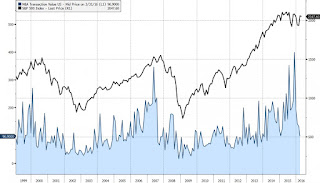

Combine this with the chart we posted last time and it's ridiculous to be talking about an economy on the move. Now add to this the deteriorating state of mergers and acquisitions, and a clearer picture emerges. One of the indicators of trouble brewing in the stock market happens to be the level of M&A activity. Put simply, mergers and acquisitions rise in good markets and they fall in bad. That's exactly what this chart demonstrates. You can see how M&A activity has plummeted. Can stocks be far behind?

We've already seen a significant drop in IPOs - Initial Public Offerings of stock by companies looking to go public. That's one in the bag. Now this.

Oh, and let's not overlook the "news" that not just Wells Fargo, but other big banks now admit to facing increased exposure to the problems of energy companies suffering from low oil prices. They've not only loaned money to energy companies who will be hard pressed to meet interest payment deadlines, but they've also extended lines of credit to these same companies that, in many cases, the banks are contractually obligated to lend - even if it's clear the company won't ever be able to pay back the loan. Remember that for months the story was these banks didn't have significant exposure here. Somehow all those loans outstanding could and would be paid back. Now it seems that "somehow" was more a hope and a wish than a realistic assessment.

At this point, we may wonder, "What's next?". Perhaps this week will provide some clues.

If trouble's brewing, and the Fed's now swinging into crisis mode, you have to seriously consider the possibility of the Fed taking some dramatic action. Like what? Well, we've seen the Japanese central bank buying ETFs in their stock market. Maybe that's on tap here. After all, no matter what you hear from the Fed or certain Wall Street economists about the economy being in good shape and getting better,you have to wonder what they're talking about as earnings continue to disappoint. Yes, disappoint, despite all the talk of "beating estimates." Earnings, measured correctly, that is, compared to the previous year's quarter, have been down four quarters in a row. What you hear about earnings "beating estimates" amounts to this: Wall Street sets the bar low, low enough to assure results will exceed estimates. There's nothing positive about that. It's just gaming the system.

Combine this with the chart we posted last time and it's ridiculous to be talking about an economy on the move. Now add to this the deteriorating state of mergers and acquisitions, and a clearer picture emerges. One of the indicators of trouble brewing in the stock market happens to be the level of M&A activity. Put simply, mergers and acquisitions rise in good markets and they fall in bad. That's exactly what this chart demonstrates. You can see how M&A activity has plummeted. Can stocks be far behind?

We've already seen a significant drop in IPOs - Initial Public Offerings of stock by companies looking to go public. That's one in the bag. Now this.

Oh, and let's not overlook the "news" that not just Wells Fargo, but other big banks now admit to facing increased exposure to the problems of energy companies suffering from low oil prices. They've not only loaned money to energy companies who will be hard pressed to meet interest payment deadlines, but they've also extended lines of credit to these same companies that, in many cases, the banks are contractually obligated to lend - even if it's clear the company won't ever be able to pay back the loan. Remember that for months the story was these banks didn't have significant exposure here. Somehow all those loans outstanding could and would be paid back. Now it seems that "somehow" was more a hope and a wish than a realistic assessment.

At this point, we may wonder, "What's next?". Perhaps this week will provide some clues.

Comments