What We Learned Last Week

Last week we learned a few things. No surprise there, since constant learning should permeate the work of anyone hoping to increase their understanding of the world, whether that's the economy, the markets, your business environment, the people around you, the people in positions of power who affect you...and on and on.

This past week a couple of items headed our list, starting with our upcoming election. While the main stream media slants its views in favor of liberal ideas in the general course of events, this election has seen this slant turn into a rather dramatic spike. But even that shouldn't surprise. If Clinton represents the bulk of liberal sentiment, and Trump opposes Clinton, the spike was inevitable. What was different this week, though, was the complete abdication of any concern with reporting things with any connection to reality. They're simply making up whatever they think will suit their agenda.

The latest manifestation of this bold turn from any connection to reality came in various reports about how Trump will react when the results of the election are announced. The MSM has decided what Trump said without any regard for the words the man used. It's not even worth repeating who said what since it clearly doesn't matter to the MSM. They simply concoct statements never made in order to portray a major threat to our political system and our personal freedom. Trump the dictator does what he wants without regard to reality - when in fact, they report whatever they want without regard to reality.

Some of you will likely shrug your shoulders and say you're not surprised. Well, I'm not surprised that you're not surprised. I guess my general avoidance of the ebb and flow of this bizarre campaign put me behind the curve on this one. I hadn't realized until this past week the depth of depravity of the MSM when it comes to this election.

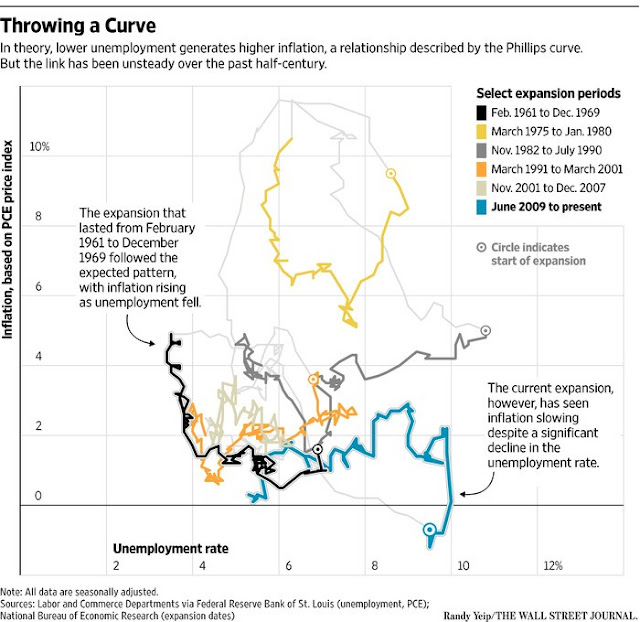

The second item we learned was that the Fed's key reason for deciding that a rate hike is in order is based on a fundamentally flawed model - again no shocker. It's just that the degree of flaw in this model wasn't apparent before we looked closer.

The model, known as the Phillips curve, claims to demonstrate an inverse relationship between inflation and the unemployment rate. As that rate declines, inflation heats up. And it seems that the Fed's increasing chatter about raising rates depends on their faith in this model. They're asserting that unemployment has declined, and therefore inflation will heat up, even though there's nothing out there right now that shows inflation heating up.

Setting aside for a moment whether it's really the case that unemployment is trending down (it may not be), even if it is, to rely on the Phillips Curve seems a bit of a stretch. The original data demonstrating this relationship was based on UK employment/inflation data from 1861 through 1957. If the patterns that data drew apply to our current times, then the following chart should show a line generally sloping downward upper left to lower right. Notice the x axis shows lower to higher unemployment left to right; the y axis shows higher to lower inflation top to bottom. Hence the downward sloping line left to right, if that Phillips curve relationship still holds. Now look at a chart of unemployment and inflation over the past half century.

Nothing resembling a Phillips Curve, wouldn't you say? Yet in 2010, Janet Yellen told lawmakers, “the Phillips curve model provides a coherent and useful framework for thinking about the influence of monetary policy on inflation.” And more recently the Atlanta Fed's President opined, “In the absence of direct evidence that inflation is in fact converging to the target and in the absence of compelling or convincing direct evidence, I think a policy maker has to act on the view that the basic relationship in the Phillips curve between inflation and employment will assert itself in a reasonable period of time as the economy tightens up.” Notice how he explicitly admits there is no meaningful direct evidence of inflation that might back up the theoretical assertion of this Phillips Curve.

Given that this blog is the farthest thing from MSM, we can safely say that you can't - or at least we can't - make stuff like this up.

This past week a couple of items headed our list, starting with our upcoming election. While the main stream media slants its views in favor of liberal ideas in the general course of events, this election has seen this slant turn into a rather dramatic spike. But even that shouldn't surprise. If Clinton represents the bulk of liberal sentiment, and Trump opposes Clinton, the spike was inevitable. What was different this week, though, was the complete abdication of any concern with reporting things with any connection to reality. They're simply making up whatever they think will suit their agenda.

The latest manifestation of this bold turn from any connection to reality came in various reports about how Trump will react when the results of the election are announced. The MSM has decided what Trump said without any regard for the words the man used. It's not even worth repeating who said what since it clearly doesn't matter to the MSM. They simply concoct statements never made in order to portray a major threat to our political system and our personal freedom. Trump the dictator does what he wants without regard to reality - when in fact, they report whatever they want without regard to reality.

Some of you will likely shrug your shoulders and say you're not surprised. Well, I'm not surprised that you're not surprised. I guess my general avoidance of the ebb and flow of this bizarre campaign put me behind the curve on this one. I hadn't realized until this past week the depth of depravity of the MSM when it comes to this election.

The second item we learned was that the Fed's key reason for deciding that a rate hike is in order is based on a fundamentally flawed model - again no shocker. It's just that the degree of flaw in this model wasn't apparent before we looked closer.

The model, known as the Phillips curve, claims to demonstrate an inverse relationship between inflation and the unemployment rate. As that rate declines, inflation heats up. And it seems that the Fed's increasing chatter about raising rates depends on their faith in this model. They're asserting that unemployment has declined, and therefore inflation will heat up, even though there's nothing out there right now that shows inflation heating up.

Setting aside for a moment whether it's really the case that unemployment is trending down (it may not be), even if it is, to rely on the Phillips Curve seems a bit of a stretch. The original data demonstrating this relationship was based on UK employment/inflation data from 1861 through 1957. If the patterns that data drew apply to our current times, then the following chart should show a line generally sloping downward upper left to lower right. Notice the x axis shows lower to higher unemployment left to right; the y axis shows higher to lower inflation top to bottom. Hence the downward sloping line left to right, if that Phillips curve relationship still holds. Now look at a chart of unemployment and inflation over the past half century.

Nothing resembling a Phillips Curve, wouldn't you say? Yet in 2010, Janet Yellen told lawmakers, “the Phillips curve model provides a coherent and useful framework for thinking about the influence of monetary policy on inflation.” And more recently the Atlanta Fed's President opined, “In the absence of direct evidence that inflation is in fact converging to the target and in the absence of compelling or convincing direct evidence, I think a policy maker has to act on the view that the basic relationship in the Phillips curve between inflation and employment will assert itself in a reasonable period of time as the economy tightens up.” Notice how he explicitly admits there is no meaningful direct evidence of inflation that might back up the theoretical assertion of this Phillips Curve.

Given that this blog is the farthest thing from MSM, we can safely say that you can't - or at least we can't - make stuff like this up.

Comments