Was That About It For The Summer Rally?

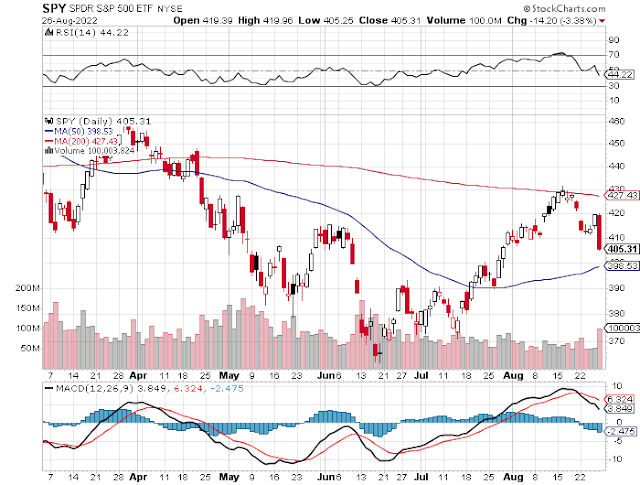

Was that about it for the summer rally in the stock market? Here's a chart of SPY, an ETF of the S&P 500:

The rally began around the middle of June. You see that, right? And you see how it bumped up against what's called "resistance" around mid-August. After that it drifted lower, with a few bumps up. Then came Friday - the red bar at the right side of the chart.

Not only was the drop large - 3.37% or 141.46 - but if you look at the red and gray bars under the candle-sticks that mark each days action, you see that volume spiked as well. That adds to the conviction of the sell-off.

Of course, the more dramatic headline was Dow falls over 1,000 points. It was actually 1,008 points, although percentage-wise - 3.03% - it was less than the S&P. But thousands hit you in the chest with more thump than hundreds. So that's one reason the media likes quoting the Dow.

Here's a chart of the Dow:

Looks just like the S&P, right?

But it was the NASDAQ that really got slammed. Check this out:

Well, it does look the same as the other two - except for one thing: the high for the rally didn't get near the 200-day moving average (the red line above the candle sticks). It didn't have enough juice to even kiss the 200-day. Visually, it's like it just got too tired. Indeed, the NASDAQ has been the sick man of the three major averages since the Bear Market began.

I'm no expert at interpreting charts, but pictures do tell a story. If you look back at the April high, this recent high fell far short. And if you expand these charts to go back to the November 2021 highs - before the Bear Market began, the April high was far short of that.

I bring this up because you may have seen the claim that this rally bumped about 50% up from the low in June to the April high. And that - the claim was made - has meant the stock market would head higher, indeed to new highs. Hurray the Bear Market is over! The claim was based on historical incidences where that indeed was the case. Unfortunately the claim skipped all those instances where it most definitely was not the case.

Sad to say, this was published and pushed in a professional publication, one distributed to investment advisors. I wonder if advisors took it seriously and upped their stock allocations.

If you or they piled in based on that specious claim, you just had your feet kicked out from under you.

Any time you hear claims like that, you need to step back and question them. Most times, they're selective and pushing someone's agenda - like Wall Street.

Bear Markets are dangerous beasts. And if this one's just getting started - which could be the case - we're in for a doozy.

Be careful out there.

Comments