For Those Who Think New York Real Estate is the Destination of Choice for Foreign Money

New York and some other U.S. cities (Miami springs to mind) attract foreign money in the form of real estate purchases. After 2008, and a bit of a shake and wiggle in real estate values in Manhattan, stability of prices took over. Naturally, people point to foreign buyers who bid up falling prices. And there's truth in that view.

For example, the wealthy families of South America live under governments which have a history of inflating their currencies and thereby destroying their currency's value (a lot more at times than our own government). So wealthy people own lots of real estate in the form of land and buildings, as well as other "tangible" items. They also send money to countries like the U.S, with such money frequently used to buy real estate in places like Manhattan and Miami to avoid paying taxes on some percentage of their property. They also avoid having their property simply expropriated by the government, which can happen in extreme cases. Foreigners typically buy expensive, aka "high end" real estate, usually in some form that can be maintained easily when they're not around, so apartments (condos, co-ops) are usually what they seek. It works out well for the foreigner, as they can either use the property as a place to crash when they visit Manhattan, or they can rent the space out and earn income on it.

While these sorts of real estate purchases result from people who "relocate" their money from their home countries as a simple matter of prudent financial planning, sometimes you'll see these sorts of purchases characterized as originating with "hot money." Hot money is the kind of money that flows in and out of countries as opportunities for higher interest payments or temporary growth prospects attract it. The hot money flows into a currency of a country that's increasing in purchasing power, or into the securities of that same country, since the value of the stocks and bonds will rise as the value of the currency rises. Of course, when the rising trend reverses - as it always does - the hot money leaves in a flash and seeks opportunity elsewhere.

Real estate purchases, however, aren't as subject to hot money flows. You don't usually see real estate being dumped en masse in a flash because, unless something extraordinary occurs, most rich folks will hold their real estate despite the ups and downs of the local market.

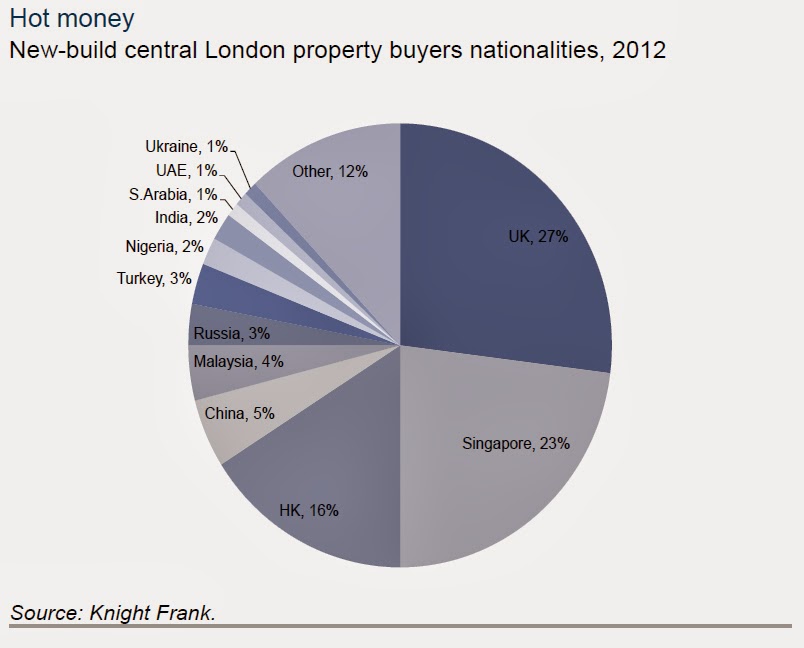

But if you think Manhattan's an attractive place for foreign money, you should see London. Despite the economic strains since 2008, and despite those who believe London's real estate (at least the high end stuff) has been increasing at an extraordinary and unsustainable rate, just check out this simple chart, which shows us who's been driving prices up in recent years. You'll see that London's really the go-to place for just about everyone. (Notice, though, that South Americans aren't represented here, unless they're part of "Other." I think they still prefer the U.S. as their primary destination.) Note especially that UK citizens comprise a distinct minority when it comes to building high-end town houses and flats in their own country.

For example, the wealthy families of South America live under governments which have a history of inflating their currencies and thereby destroying their currency's value (a lot more at times than our own government). So wealthy people own lots of real estate in the form of land and buildings, as well as other "tangible" items. They also send money to countries like the U.S, with such money frequently used to buy real estate in places like Manhattan and Miami to avoid paying taxes on some percentage of their property. They also avoid having their property simply expropriated by the government, which can happen in extreme cases. Foreigners typically buy expensive, aka "high end" real estate, usually in some form that can be maintained easily when they're not around, so apartments (condos, co-ops) are usually what they seek. It works out well for the foreigner, as they can either use the property as a place to crash when they visit Manhattan, or they can rent the space out and earn income on it.

While these sorts of real estate purchases result from people who "relocate" their money from their home countries as a simple matter of prudent financial planning, sometimes you'll see these sorts of purchases characterized as originating with "hot money." Hot money is the kind of money that flows in and out of countries as opportunities for higher interest payments or temporary growth prospects attract it. The hot money flows into a currency of a country that's increasing in purchasing power, or into the securities of that same country, since the value of the stocks and bonds will rise as the value of the currency rises. Of course, when the rising trend reverses - as it always does - the hot money leaves in a flash and seeks opportunity elsewhere.

Real estate purchases, however, aren't as subject to hot money flows. You don't usually see real estate being dumped en masse in a flash because, unless something extraordinary occurs, most rich folks will hold their real estate despite the ups and downs of the local market.

But if you think Manhattan's an attractive place for foreign money, you should see London. Despite the economic strains since 2008, and despite those who believe London's real estate (at least the high end stuff) has been increasing at an extraordinary and unsustainable rate, just check out this simple chart, which shows us who's been driving prices up in recent years. You'll see that London's really the go-to place for just about everyone. (Notice, though, that South Americans aren't represented here, unless they're part of "Other." I think they still prefer the U.S. as their primary destination.) Note especially that UK citizens comprise a distinct minority when it comes to building high-end town houses and flats in their own country.

Comments